Click on Permohonan or Application depending on your chosen language. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

30 April without business income and 30 June with business income PIT final payment due date.

. The Internal Revenue Service extended the 2019 federal income tax filing and payment deadline for three months from April 15 to July 15 2020. The 2022 filing programme stipulates the due date for the submission of the RF ie Form BT e-BT for resident individuals who are non-citizen workers holding key positions. The above is a complete guide for.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Calculations RM Rate TaxRM A. Download a copy of the form and fill in your details.

A nd b Monthly Tax Deduction MTD. Notification of chargeability of an individual who first arrives in Malaysia. Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts.

22019 Date of Publication. Grace period is given until 15 May 2019 for the e-Filing of Form BE Form e-BE for Year of Assessment 2018. Can I Still Get My Tax Refund From Last Year.

Form EA Important Notes. From the date of his not less than one month prior to the date of the cessation of employment From 15 April 2020 onwards From 15 April 2020 onwards From 15 April 2020 onwards First instalment payment under the Notice of Instalment Payment CP500 31 March 2020 30 April 2020 Payment of Monthly Tax Deduction MTD for the month of March 2020. Yearly remuneration statement Form EA Deadline.

Tax Calendar 2019-2020 of specific goods tax. Malaysia Residents Income Tax Tables in 2019. 14 March 2019 Page 6 of 12 a the payment of corporate income tax.

Personal income tax PIT due dates PIT return due date. Declaration report of companies Form E deadline. Malaysia Various Tax Deadlines Extended Due.

Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year. On the First 5000 Next 15000. Registering as a first-time taxpayer on e-Daftar.

On the First 5000. The Director is jointly and severally liable in respect of the companys tax and any debt that is due and payable. You can file your taxes on ezHASiL on the LHDN website.

According to Lembaga Hasil Dalam Negeri LHDN the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Know the Due Dates of Income for All Return Forms Year 2019 Who is accountable for paying the tax liabilities of the company if it fails to pay the corporate and monthly tax deductions to employees on due dates. Timeline to be complied with Within 10 days after the end of each month.

Income Tax Malaysia 2019 Due Date. Annual income statement prepared by company to employees for tax submission purpose. Personal income tax filing Form BE.

By 30 April in the year following that YA Tax returns are not required to be filed for specific groups of employees where requirements are met. Employer Individuals Companies especially on the type of Forms to be submitted throughout the year 2019 due dates as per the relevant Act and the grace. The new deadline was automatic for all taxpayers who also had until July 15 to pay any taxes that.

Malaysia extends income tax filing deadline March 29 2020 April 5 2020 COVID-19 Filing deadlines Filing return Submission of returns Asia-Pacific Malaysia. Form E Important Notes. The deadline for filing income tax return forms in Malaysia has been extended by two months.

If a taxpayer furnished his Form e-BE for Year of Assessment 2018 on 16 May 2019 the. Go back to the previous page and click on Next. Review the 2019 Malaysia income tax rates and thresholds to allow calculation of salary after tax in 2019 when factoring in health insurance contributions pension contributions and other salary taxes in Malaysia.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Following the Malaysian Governments implementation of the Movement Control Order from March 18 2020 to March 31 2020 to control the spread of COVID-19 the Malaysian Inland Revenue Board MIRB announced on March 17 2020 that tax return filing and balance of tax. Also the MIRB has closed all its office premises until 14 April 2020 but is providing some.

Within 2 months of date of arrival. For the taxpayers except State Economics Enterprises. The due date for submission of Form BE for Year of Assessment 2018 is 30 April 2019.

Tax return filing and payment deadlines extended by two months. - The due date for quarterly payment of income tax and quarterly return. Commission fees statement prepared by company to agents dealers distributors.

Form used by company to declare employees status and their salary details to LHDN. Multiple countries dont levy income taxes but that feature may come with a different price to pay if you choose to relocate to any of them. 30 April without business income and 30 June with business income PIT estimated payment due dates.

Value Added Tax Wikipedia - That said 50 states income ta. The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of. As of April 15 2022 the three-year grace period will end for the 2018 tax year with a filing deadline in April 2019.

The extension was given in response to the global coronavirus pandemic sweeping the United States. The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. For State Economics Enterprises.

Malaysian income tax return form filing programme for the year 2019 for all income tax return forms with due dates as per the relevant Act and grace periods and more. September 18 2021 Post a Comment Not everyone pays the same amount though. Based on the Income Tax Act 1967 ITA Section 75A the company director is responsible.

Submission of income tax return - Resident - Non-resident. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30.

Provision For Income Tax Definition Formula Calculation Examples

Individual Income Tax In Malaysia For Expatriates

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

How To Create An Income Tax Calculator In Excel Youtube

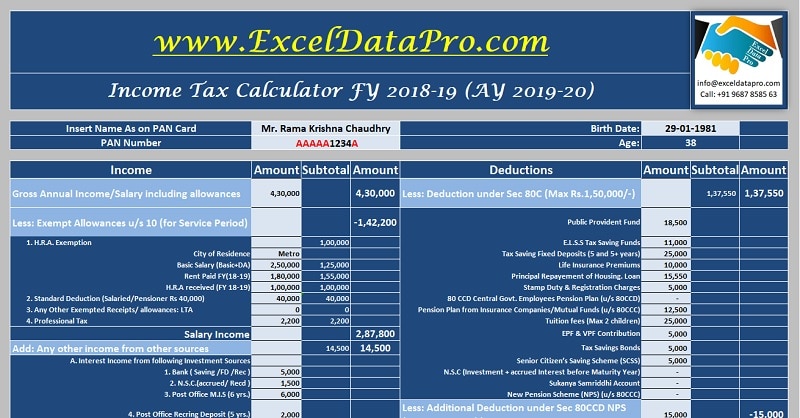

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Thailand Medical Tourism Review Of 2018 Including Up To Date Medical Statistics And Information Relating To Thailand Medical Tourism Tourism Malaysia Tourism

Malaysia Personal Income Tax Guide 2021 Ya 2020

Complete Tax Due Dates For All Return Forms For The Year 2019 Informative Due Date Dating

How To Calculate Foreigner S Income Tax In China China Admissions

When Are Taxes Due In 2022 Forbes Advisor

How To Calculate Foreigner S Income Tax In China China Admissions

How Is Taxable Income Calculated

Freetaxusa Income Tax Extension Federal Filing E File Irs Extension Online Free Federal Filing Tax Extension Free Tax Filing Filing Taxes

Flowchart Final Income Tax Download Scientific Diagram

Provision For Income Tax Definition Formula Calculation Examples

Do Retirees Pay Income Tax Thaiembassy Com

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)